Can you imagine a world without cash?

25 / 07 / 2024

A cashless society is still a distant prospect, but what can it tell us about how to make digital payments more accessible and inclusive today?

In my opinion, the prospect of a cashless world (or even a cashless country) is still a very distant prospect. However, I also think that by imagining what it would take to go fully cashless, we can also understand what is needed to make digital payments more accessible and inclusive today.

But before I come on to that, let me share with you these words from the Bank of England:

“The term ‘cashless society’ is however, and will for the foreseeable future continue to be, an implausible prospect for the United Kingdom (and indeed for most other countries). It is more realistic to think of a ‘less-cash society’ in which the use of cash gradually becomes even more restricted to lower value transactions and to those transactions where both parties seek anonymity.”

What I find most interesting about this statement is when it was made: it is from an article published by the Bank of England in December 1982 in their quarterly bulletin, over 40 years ago.

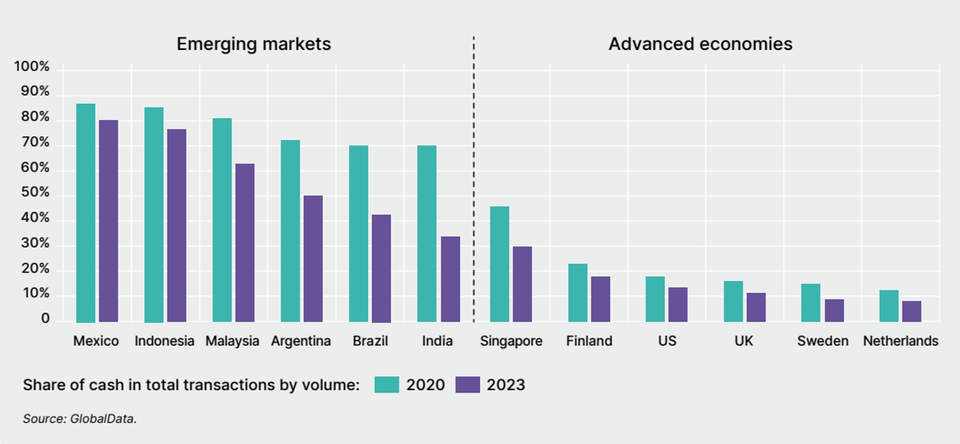

It’s a remarkably accurate prediction, especially given the huge timespan over which it was made, as we have indeed seen a continued decline in the usage of cash globally (as shown below), yet the idea of any country completely eliminating cash from their society still seems as far away as ever.

But why does it still seem like only a distant possibility? There are, after all, many arguments that could be made for eliminating cash, for example:

- Digital payments could potentially have a carbon footprint that is 36 times less than that of cash (as highlighted by this study and reiterated by Patrice Geoffron, Professor of Economics at University Paris-Dauphine-PSL in this podcast episode)

- The per-transaction social cost of cash rises as the volume of transactions decreases. Many costs of handling cash are fixed (e.g. for merchants to have a cash register and deposit their takings, for banks to provide and manage ATMs) so the less use that is made of them the higher the overhead.

- Whilst the majority of cash transactions are legitimate, it is often used for illegitimate purposes such as tax evasion, bribery and the purchase of illegal goods and services.

In a study conducted by Worldline we found that a surprising 72.3% of respondents agreed that they would be happy to complete all their payments digitally (and never use cash at all). And Gen Zs were even more positive, with 81.6% of them agreeing.

But I think these last statistics also provide a clue as to why cash is likely to stick around for some time. Even if a large majority of people in society would be happy to see an end to physical coins and banknotes, removing cash would create a huge barrier to financial inclusion for those who are unable or unwilling to rely fully on digital payment means.

However, I think it is unambitious to believe that the only way to secure financial inclusion is to keep cash. In fact, those who can’t or won’t pay digitally already face exclusion barriers today, as highlighted in our recent infographic. They sometimes have to pay more for basic services if they can’t setup a direct debit, or face higher interest rates for borrowing because they haven’t built up a credit history. These people are already facing various kinds of financial exclusion and the mere existence of cash is not helping them.

So, rather than simply relying on cash, I think we need to address the harder question of how digital payments can be made fully accessible and inclusive? In our Navigating Digital Payments report we emphasized that part of the solution relates to education and regulation. Education to not only help people learn how to use different payment means, but also to understand the differences and trade-offs between them. Regulation not only to encourage and stimulate the adoption of digital payments, but also to ensure that solutions are designed to be accessible.

We also believe that technology will have a role to play to, in particular:

- Enabling people to authenticate and pay using biometrics – reducing reliance on devices or having to remember passwords and PINs

- Helping people to access services using natural language interfaces, either by voice or typing

- Explaining financial products and services to people in language tailored to them, in a conversational way

AI is increasingly being used in each of these cases to improve the overall experience and reduce costs.

So, to return to my initial remarks, the words from the Bank of England 42 years ago are still relevant today: cashlessness remains far away, but society is continuing to move towards less-cash. And in this context, making digital payments accessible and inclusive for all is as important and urgent as it has ever been.

David Daly

-

-

-

Consumer Finance: The Transformative Impact of Open Banking & Open Finance

Learn more -

Elevating Service Efficiency: Boscolo Hôtels & SPAS Group's transformation with Worldline’s Integrated Payment Systems.

-

Will augmented reality transform how we shop?

-

-

Worldline enables GarantiBBVA International N.V. to comply with EU Instant Payments Regulation with cloud-based solution

Learn more -

Learn how NFC payments empower your business