EV Charging and Payments insights by Radu-Vasile Pop

19 / 01 / 2024

Pierre Veillon - EV Charging, Parking and Mobility Segment Marketing Manager, Worldline, discusses the latest trends and payments evolutions within the EV Charging market with Radu-Vasile Pop - Head of EV Charging vertical, Worldline.

Hi Radu, welcome! Thanks for joining us. Let’s get started—could you give us a brief overview of your role?

As the European Head of EV Charging vertical at Worldline, I play a key role in strategically expanding our EV charging payment solutions throughout Europe. I find that a human-centric approach is key to success in this dynamic field. In my day-to-day, I dedicate significant time to developing meaningful relationships, fostering business growth, and leading my team with a human touch.

My expertise lies in seamlessly bridging the realms of product, marketing, and sales, ensuring a cohesive and collaborative environment. Managing teams, I prioritise empathy, valuing each individual's contribution to our shared goals. My passion for business growth fuels my commitment to expanding our presence while keeping a sharp focus on client satisfaction. In essence, I am deeply invested in embodying Worldline's ethos—where technology meets humanity to develop EV Charging payments across the continent.

Thanks! Sounds very exciting! So, where do we stand today, by the beginning of 2024, in terms of paying for charging an electric vehicle?

Let's be realistic, at present, the prevailing approach for identifying electric vehicle charging stations (EVCS) owners involves RFID cards, systematically paired with e-commerce subscription payments. While this methodology is expected to remain dominant for the next few years, a noticeable shift is taking place. Over the past months, my team and I have been actively engaged in various EV exhibitions, witnessing a significant change. Approximately 80-90% of EVCS manufacturers are now actively pursuing payment terminals for DC fast charging stations. This shift unequivocally reflects the influence of the EU Directive.

In some European countries, the growth of electric vehicles (EVs) appears to be slowing down. Many sceptics attribute this slowdown to the perceived difficulty in finding charging stations, with a predominant concern being the perceived inadequacy of EV autonomy. As the EV Charging vertical manager at Worldline, and also an EV driver, what is your stance on this issue?

Firstly, the growth of the EV fleet continues, but possibly at a slightly slower pace due to reduced incentives in some countries. However, the global EV revolution is undeniably underway and shows no signs of abating. The European Union (EU) has set explicit carbon-neutral objectives for 2050 and aims to cease fossil fuel sales by 2035, propelling the ongoing transformation.

Moreover, driving an EV brings about some differences in behaviour; people adopt varied charging patterns, integrating charging into their routine—whether at home, shopping or at the office.

The registration figures for EVs are consistently on the rise, turning the provision of charging infrastructure and electricity into a lucrative business and a crucial image factor for the utility industry. This realisation has also extended to providers in diverse sectors. Consequently, it is foreseeable that shortly, it won't be EV drivers vying for a spot at the public charging stations, but rather the Charging Point Operators (CPOs) or eMobility Services Providers (eMSPs) competing for charging customers.

Great! Globally, how does Worldline position itself in this growing sector? Can you tell us more about their EV Charging Payments Suite?

Well, Worldline stands as the European leader in payment services, encompassing the entire spectrum of payments for merchants. Our positioning is crystal clear: we aspire to be the payment leader in the EV Charging business.

We adopt a centralised approach with hardware manufacturers, providing them with payment terminals seamlessly integrated into their charging stations. Throughout this process, we support and guide them, offering training on payment fundamentals to enhance their expertise and autonomy. Additionally, we extend our services to CPOs and eMSPs, offering e-commerce solutions and commercial acquiring.

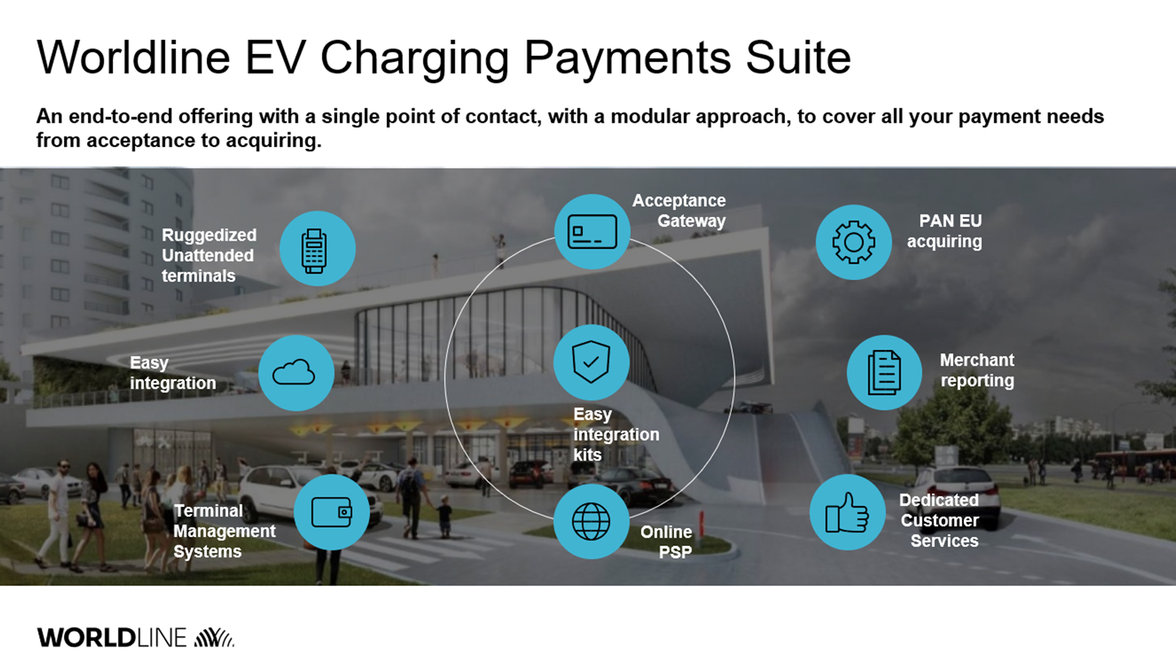

There are unique aspects in the EV Charging business concerning payments. We address these specific demands to ensure client satisfaction. Consequently, we made the strategic decision to introduce EV Charging Payments Suite, a dedicated solution tailored specifically to this sector. Our offering comprises Worldline's best-in-class payment terminals, e-commerce, and commercial acquiring, catering to several tens of thousands of merchants across Europe. Leveraging our extensive expertise, we have meticulously tuned our products to align seamlessly with the specific market requirements of this emerging segment.

Find out more about the solution EV Charging Payments Suite

Is payment truly critical in EV Charging?

Yes, it definitely is! As I mentioned earlier, CPOs and eMSPs will soon compete for customers to use their charging stations. Payment is a crucial part of the customer experience. Previously, people seamlessly paid when fueling their cars, mostly with card payments—easy, reliable, and offering a consistent experience everywhere. They expect a similar experience for charging.

Unlike fuelling, charging involves not only card payments but also e-commerce, QR code scanning, app downloads, etc. This represents a significant difference from the traditional fueling payment process. Moreover, in the realm of e-commerce, customers are accustomed to excellent experiences in other sectors like retail or entertainment. Therefore, a positive customer experience at the charging station becomes a critical success factor and an additional catalyst for electromobility. Simple, convenient payment processes rank high on customers' wish lists.

Returning to your clients, the Hardware Manufacturers, CPOs, and eMSPs, how does Worldline distinguish itself from payment competitors?

Let me address that question in three key aspects:

Firstly, our payment products stand out as best-in-class. Handling billions of transactions annually, we prioritise the highest standards of security and confidentiality in safeguarding payment data. Operating across Europe, we maintain a consistent and uncompromising offer.

Secondly, we uniquely provide the complete payment chain—including secure and certified payment terminals, e-commerce solutions, and commercial acquiring—under a Pan-European license. This brings significant advantages to our clients:

- Partnering with Worldline allows EV Charging Hardware Manufacturers, CPOs, or eMSPs to expand their business seamlessly across Europe, and beyond, with a single payment provider. This not only promotes scale economies but also minimises daily operational challenges. In the EV Charging business, a swift Go-To-Market is pivotal. Our clients are eager to secure positions, and dealing with different providers for payment terminals, e-commerce, and commercial acquiring is simply impractical and time-consuming.

- Our clients benefit from a unified global platform, providing a single point for visualising, tracking, and monitoring all payment activities. Whether transactions occur through a payment terminal, an e-commerce transaction via an application, or a QR Code, everything is centralised, including commercial acquiring transactions.

- This singular platform is designed to accommodate future sector needs, aligning with omnichannel use cases commonly observed in retail and transportation.

Lastly, we prioritise building strong relationships with our clients. This begins from the onboarding stage, where dedicated personnel guide our clients through the process, ensuring they are operational within a matter of days. This personalised approach sets us apart, emphasising our commitment to human interactions and assuring clients that they can reach out to the same team for assistance at any time.

Could you provide additional technical details about your solution? Specifically, which payment methods do you support, both for unattended transactions and e-commerce? And what about commercial acquiring?

The unattended solution, (e.g. paying with your bank card at a charging station) encompasses various terminals supporting both contact and contactless payments through chip or NFC, along with PIN input. This is complemented by a backend solution for monitoring payment terminals and client payment flows. The system also accommodates software-bound 'kiosks,' integrating multiple charging stations monitored by a single payment terminal—a trend notably observed in AC slow charging.

On the e-commerce front, our platform seamlessly integrates a wide array of online payment methods into mobile applications provided by CPOs and eMSPs to their end customers. Our suite supports over 200 payment methods, including international and national debit/credit cards, PayPal, Apple Pay, Google Pay, and more. It ensures smooth cross-border operations while meeting all international and local payment requirements across Europe.

In terms of commercial acquiring, Worldline holds a Pan-European license, including Switzerland and the UK. Commercial acquiring, also known as merchant acquiring, occurs when merchants (CPOs or eMSPs) sign an acquiring contract with an acquirer to receive payments directly into their bank account. Companies like Worldline, acting as acquirers, collect approved card-based payments and route them through card schemes (e.g., VISA/Mastercard) networks to the client's bank (issuer). The acquirer then conducts settlement, crediting the merchant's account and debiting the client’s account.

With Worldline's acquiring solution spanning 30+ countries, it serves as a compelling advantage for our clients, enabling us to actively support their business expansion across Europe.

Thank you, Radu. Now, I would like to gain a better understanding of the payment process when I insert my bank card into a payment terminal at a charging station. Could you please provide more details?

When customers pay with a card or smartphone at the bakery, supermarket, or restaurant, the underlying processes are relatively easy to understand. The appointed payment service provider verifies if the card is valid and if the required amount is covered in the bank account. If both conditions are met, the payment is authorised, and the money is then transferred to the merchant.

However, paying to recharge your car is a bit different: the authorisation often takes place at the charging station through the payment method. After the validity check, the merchant reserves an amount of money in the bank account of the charging customer. At this stage, the final charging amount is unknown. Once this money is reserved (provided the account balance is higher than the requested amount), the charging process can start, but the cost is limited to the reserved amount in the client's bank account.

To ensure a smooth execution of the somewhat complex charging process, incremental money reservations can be requested. The goal is to strike a balance between payment security and a positive customer experience. You wouldn’t want to be stopped at €10 in the middle of a charge because the initially reserved amount was too low! Moreover, if the reserved amount is significantly higher than the final charging amount, the reserved amount is cleared. Dealing with this type of use case requires specific business expertise that we possess, and that's also why we have developed a payment suite dedicated to this sector.

Great! Last words Radu, what makes you go to work every day?

My passion for payments is matched only by my excitement for the EV charging industry's transformative journey. As the Head of the EV Charging vertical at Worldline, navigating the complexities of this rapidly evolving sector is not just a job; it's a commitment to revolutionising the way we power our vehicles. From driving positive customer experiences to embracing innovative payment solutions, our mission is clear: to lead the charge in shaping the future of electric mobility across Europe. It's not just business; it's the electrifying fusion of technology, vision, and a commitment to sustainable progress. We humbly feel that, at our level, we are contributing to the reduction of the environmental impact of passenger transportation.

Radu Vasile

You might also be interested in

-

-

-

Consumer Finance: The Transformative Impact of Open Banking & Open Finance

Learn more -

Elevating Service Efficiency: Boscolo Hôtels & SPAS Group's transformation with Worldline’s Integrated Payment Systems.

-

Can sports equipment become more sustainable?

-

-

Worldline enables GarantiBBVA International N.V. to comply with EU Instant Payments Regulation with cloud-based solution

Learn more -

Learn how NFC payments empower your business