Worldline welcomes Ingenico, creating a new world-class leader in payment services

By combining forces, Worldline gets one step closer to our vision of enabling sustainable and profitable economic growth for banks, merchants and the entire payments ecosystem

Bezons — 30 / 10 / 2020

by combining forces with Ingenico, Worldline will become Europe’s new world-class leader in payment services and joins the league of international payment leaders. Worldline is committed to operating payment solutions that enable viable economic growth and reinforce trust and security in our societies. With its global footprint and its dedication to excellence, innovation and sustainability, Worldline is set to accelerate the development of the European payments industry, further shaping new ways of paying, living and doing business.

Merchants can expect solutions and services that support their growth agenda, and a wider range of digital payment capabilities for operational efficiencies and better customer engagement through:

- State-of-the-art integrated payment solutions

- Advanced technology

- Enhanced innovation capacities

- Extended global footprint

“This is a very exciting milestone for Worldline, specifically designed to decidedly reinforce the value proposition of our businesses. Having the scale and now global capabilities, we have reshaped our group entirely in order to support, now more than ever, our clients, merchants and banks in particular, enabling them to rely on state-of-the-art electronic payment services to accelerate their own growth as well as their digital transformation strategy. In doing so, we are more than ever committed to contributing to the sustainable growth of the societies we operate in, while remaining at the highest possible level of social and environmental responsibility. Despite the difficult times we are all facing at the moment, I have never been this confident in the group’s potential and future and in its 20,000 employees.”

Gilles Grapinet, Chairman and CEO of Worldline

The new Worldline in a nutshell

- Worldline is the largest European player in payment services and the fourth largest player worldwide, with pro forma revenues of €5.3 billion in 2019.

- Worldline provides its clients with sustainable, trusted and secure solutions across the payment value chain, fostering their business growth wherever they are located.

- With 20,000 employees and powered by the brightest talents in the payments industry, Worldline is shaping new ways of paying, living and doing business.

- With a physical presence in over 50 countries, Worldline is the only European player with an international footprint to rival international payments peers based in the US, providing the full payment ecosystem, from POS acceptance to merchant acquisition. The newly expanded Worldline now has broad access to the US market, greater exposure to merchants in Latin America and Asia-Pacific and the potential for faster expansion in countries with a lower card penetration.

- Worldline offers best-in-class payment services, ranging from online payments, omnichannel solutions and a broad portfolio of payment terminals to issuing & acquiring and digital banking to one million merchants and 1,200 banks and financial institutions, fostering their business growth with deep operational expertise and economies of scale.

A unique value proposition for customers

We bring together Worldline’s extensive coverage of the payment value chain and its expertise in cross-border acquiring coupled with Ingenico’s global exposure to online commerce. Worldline is the competitive choice for merchants and offers clients unmatched coverage of the payments value chain with a unique combination of online, instore and specialised vertical solutions.

Unparalleled footprint and cross-border expertise to serve multinational players

Across Europe, Worldline has a significant presence, with, among others, a leadership position in Germany, a strong position in the Nordic countries and enhanced access to French banks and merchants. These geographical footprint and scale give Worldline strong commercial advantages for multinational merchants, providing customers with enhanced offerings for cross-border payments that can boost their operational efficiency and their innovation agenda.

Payment partner of choice for merchants of all sizes

The new Worldline can meet merchants’ local and global needs. In many countries, the company’s roots go back to the emergence of digital payments with a track record at the heart of national payment landscapes in countries including Belgium, Luxembourg, Switzerland and Austria. Approximately 180,000 merchants within retail, hospitality and the service sector can continue to rely on our proven services. For new customers, on-boarding will be faster and easier, thanks to digital solutions for SMEs and a hardware-independent acceptance platform.

Deep industry understanding for specialised sectors

The distinctive strengths of the new Worldline within different vertical markets create a diverse and powerful solutions portfolio and expert partnerships with key industry players. Our customer-centric organization is dedicated to specialized segments, with Ingenico’s strong assets for retail, travel, health and e-commerce that are complementary to Worldline’s strong heritage in financial services, hospitality, petrol, luxury retail and transportation.

Powering the payments industry with state-of-the-art terminals

Thanks to immediate access to some of the most advanced terminals in the industry, Worldline benefits from an extended global footprint and an undisputed know-how in POS and payment acceptance. By providing the best-tailored payments acceptance solutions to in-store merchants, Worldline is leveraging innovative payment solutions to bring the best customer-experience across the globe.

Now more than ever, accelerated e-Commerce

Worldline is the largest merchant acquirer and third largest online payment acceptance provider in Europe with c. 250,000 e-commerce customers and websites, accepting more than 350 payment methods and with connections to more than 150 local acquirers. Our internationally renowned gateway brings digital natives’ features to retailers across the world.

Enlarging perspectives for Financial Services

As the largest payment processor in Europe, with a successful track record of forging strategic partnerships with financial institutions, Worldline is leading the next-generation payment services such as account-based payments and instant payments. The combination with Ingenico increases Worldline’s payment volumes, widening opportunities for partnerships with financial institutions in addition to 1,200 financial institutions that Worldline currently works with, processing c. 5.6 billion acquiring transactions each year.

Shaping the future of payments

Innovation is our DNA

To contribute to shaping the future of payments and supporting customers in leveraging the shifts in consumer’s behaviours related to COVID-19 and beyond, Worldline will further strengthen product innovation and reinforce its investment capabilities, with R&D investment in excess of €300 million. To shape new ways of paying, living and doing business, Worldline keeps exploring the future of payments through different domains of exploration:

- Personal payments terminal

- New payment in store

- Social & voice commerce

- New payment platforms

- Data services

- Digital ticketing

- etc

Payments solutions to support sustainable economic growth

Worldline is committed to designing and operating digital payment and transactional solutions that enable sustainable economic growth and reinforce trust and security in our societies. With the integration of Ingenico, Worldline will continue to deliver on its vision of a trusted, secure and environmentally friendly payments partner. At this time of great economic and social challenges, the new Worldline will accelerate the transition towards a less cash-reliant economy, whilst making sure this process is sustainable, responsible and socially inclusive.

An expertise relying on the best Worldline & Ingenico talents

Worldline’s success is built upon the talent and passion of colleagues who are experts in their fields, sharing a commitment to excellence, responsibility and innovation. The combined company benefits from a talent pool of some 20,000 experts and a history of almost 50 years working at the heart of the payments industry.

A growth story to continue

The new Worldline is ready to play a key role in designing a more innovative European payments space and reshaping the future of payments in Europe and beyond. Ingenico’s global presence will be a platform for expansion into new markets, creating significant possibilities for business growth, to support its strong ambition to shaping the future of payments.

About Worldline

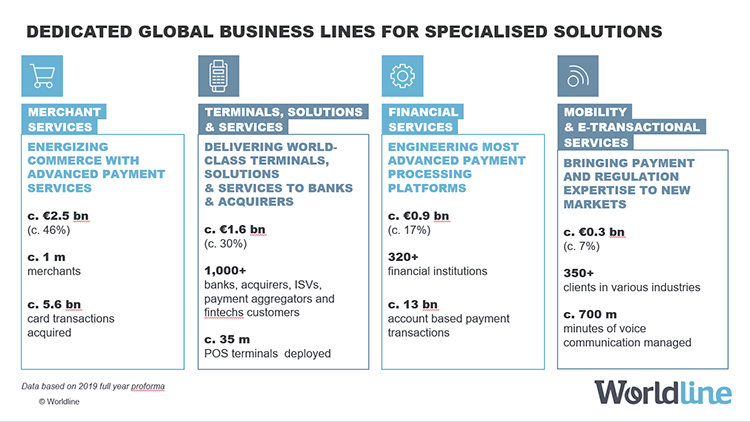

Worldline [Euronext: WLN] is the European leader in the payments and transactional services industry and #4 player worldwide. With its global reach and its commitment to innovation, Worldline is the technology partner of choice for merchants, banks and third-party acquirers as well as public transport operators, government agencies and industrial companies in all sectors. Powered by over 20,000 employees in more than 50 countries, Worldline provides its clients with sustainable, trusted and secure solutions across the payment value chain, fostering their business growth wherever they are. Services offered by Worldline in the areas of Merchant Services; Terminals, Solutions & Services; Financial Services and Mobility & e-Transactional Services include domestic and cross-border commercial acquiring, both in-store and online, highly-secure payment transaction processing, a broad portfolio of payment terminals as well as e-ticketing and digital services in the industrial environment. In 2019 Worldline generated a proforma revenue of 5.3 billion euros. worldline.com

Press Contacts

Susanne Stöger

T +43 1 71701 6524

E susanne.stoeger@worldline.com

Hélène Carlander

T +33 (0)7 72 25 96 04

E helene.carlander@ingenico.com

-

-

-

Swift Service Bureau Messaging & Connectivity

Learn more -

Discover how LCL and Worldline are transforming customer relationships with generative AI

-

What will be the big changes in banking?

-

-

-

Worldline partners with Visa Acceptance Solutions to deliver data-driven fraud management solution

Learn more -

2025 Capgemini World Payments Report: Velocity meets value to enable the future of payments