CBDC-to-the-Rescue-of-International-Payments

13 / 06 / 2022

We have talked previously about the global rise of Central Bank Digital Currency, also known as CBDC. Over the years, the form of money and payments has evolved tremendously, and this will continue in the digital era. While physical cash slowly made room for debit, credit cards and electronic payments, we are now seeing the rise of digital money. The emergence of CBDC is part of this development.

CBDC is an electronic form of central bank money that citizens can use to make digital payments and store value. Currently, 87 countries1 are actively working on CBDCs, either deployed, in development or still in the research phase. CBDCs are digital currencies issued by a central bank. Essentially the country’s fiat currency, but in digital form. This digital currency can be token-based or account-based. CBDCs will be a new form of money that people, and businesses could use to carry out transactions.

In one of this year’s EBAday sessions, Worldline’s Head of Financial Services, Michael Steinbach, discussed with his fellow panelists if a multiple CBDC platform for cross-border payments addresses the pain points of international payments and, if so, how? And more importantly, by when? In the panel discussion, Steinbach was joined by Petia Niederländer, Director at ÖNB, Marc Recker, Global Head of Product - Institutional Cash Management at Deutsche Bank, Thierry Chilosi, Chief Executive Europe at SWIFT and Petra Plompen, Senior Manager at EBA CLEARING.

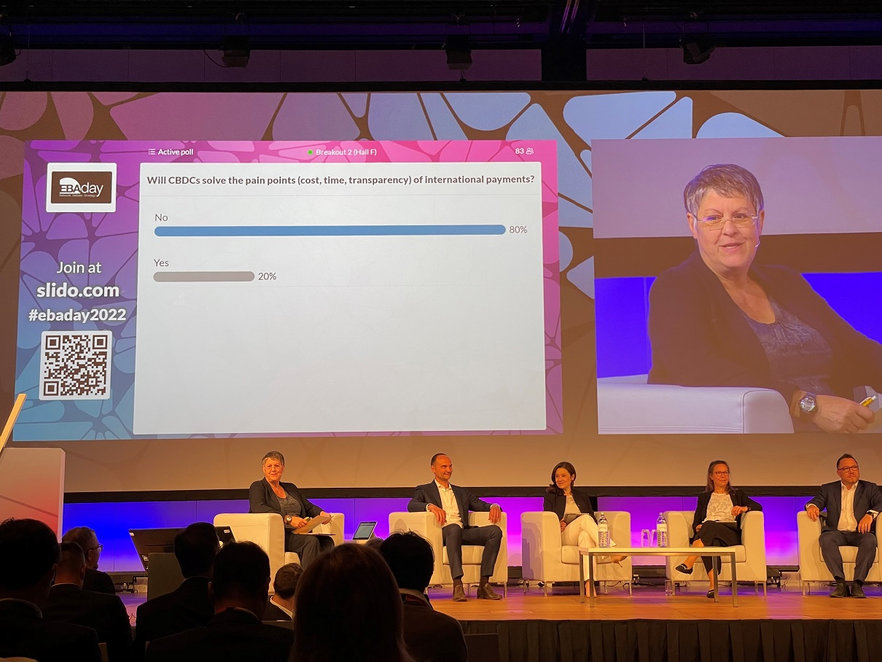

The session started with a poll asking: “Will CBDCs solve international payments' pain points (cost, time, transparency)?” It was a surprise to me that the audience was skeptical about this new form of payment. Around 80% of the audience answered the question with a clear ‘No.’ I was curious to see if their opinion would change once the panelists started discussing this topic.

Inclusiveness and simplified cross-border payments

It’s no surprise that CBDC is an important topic during this year’s EBAday, as CBDC has the potential to make a significant impact in the financial industry. Inclusion is one of the most significant advantages this digital currency has over existing means of payment. Even today, a large percentage of the world’s population does not have access to any financial services. CBDCs can ensure easy access to a monetary system while remaining low-cost and efficient. This can be extremely helpful for developing countries or remote locations where access to bank accounts is limited.

However, assuring this inclusiveness also brings challenges. Not everyone has a bank account but using CBDC should not be limited to those who only have bank accounts. Many corporations focus on making a profit, and it is unclear how a group of unbanked people would be attractive to them. However, if participants are the gateway to using a CBDC (e.g., via a wallet), they will need to be incentivized to offer access to all. Another issue is potential access to a mobile device; CBDCs should not only be available to those who own one; they should also be available for people without mobile access. Given that part of the world has yet to have access to digital currencies, and that some don’t yet trust them, it will undoubtedly be some time before CBDCs are universally accepted and adopted.

Besides inclusion, another potential opportunity of CBDC might be cross-border payments. During the session it became clear that this opportunity is not recognized by all. The current cross-border payment chain is under pressure as innovative technologies unlock new payment chains, resolving high costs, lengthy settlement times and lack of transparency. An international system for transferring CBDCs could simplify this system. At the same time, a big challenge is that, according to a recent study by the BIS2 (Bank for International Settlements), there is still much work to make CBDC cross-border payments possible.

The same question asked at the start of the session was asked again at the end. Did their views change? Barely. The public became even a bit more skeptical with around 85% saying no about CBDC being the solution for international payments' pain points.

However, their skepticism is not without logic. The pain points we experience with cross-border payments, such as associated costs and time, are also being attacked by other payment solutions like Instant Payments and SWIFT GPI. CBDC is a practical addition but will not be the only ingredient.

Innovation in motion

I believe that digital currencies won’t replace any other current payment method; they will be an addition to these methods. At Worldline, we know how fast developments in the payments industry can move. Even though the ideas need more structure to prove their potential, financial service providers should support innovation in the industry. Innovation is part of Worldline’s DNA, and we welcome and actively participate in innovative digital payments initiatives.

While CBDC offers benefits and creates challenges, it shows innovation within the financial industry. This can only be a beneficial aspect of such a digital currency. There can still be improvements before this payment method becomes part of our day-to-day life, but I see CBDC as a welcome addition to the possibilities to pay. As a full-service provider, Worldline is perfectly positioned to support central banks to make it work. I’m interested to see where these innovations will lead the financial sector in the near future.

1: EACHA: Central Bank Digital Currencies in Europe, 2022

2: BIS: Central bank digital currencies for cross-border payments, 2021

Edward van Dooren

-

-

-

Consumer Finance: The Transformative Impact of Open Banking & Open Finance

Learn more -

Elevating Service Efficiency: Boscolo Hôtels & SPAS Group's transformation with Worldline’s Integrated Payment Systems.

-

IoT payment revolution: The future of invisible transactions

-

-

Worldline enables GarantiBBVA International N.V. to comply with EU Instant Payments Regulation with cloud-based solution

Learn more -

Learn how NFC payments empower your business