How does a payment transaction really work?

17 / 11 / 2022

Tips and tricks for merchants who want to receive their revenue in a quick and secure way

Tips and tricks for merchants who want to receive their revenue in a quick and secure way:

We have all been there: The barista at your local coffee shop asks you how you´d like to pay for your latte – cash or card? In the case of the latter, you take out your card, tap it on their payment terminal and wait for the beep: approved within seconds. The reality of what happens behind the scenes of this transaction and how the whole communication between the different parties takes place, is not something that you care much about. as long as it goes through.

Now, what if you are the recipient of this money transfer (you’re the merchant)? If this is the case, you should pay attention to what comes next in this article. It will show how you get your revenue in your bank account, who is responsible for making it happen, and a few tricks on how to negotiate a better payment deal for your business.

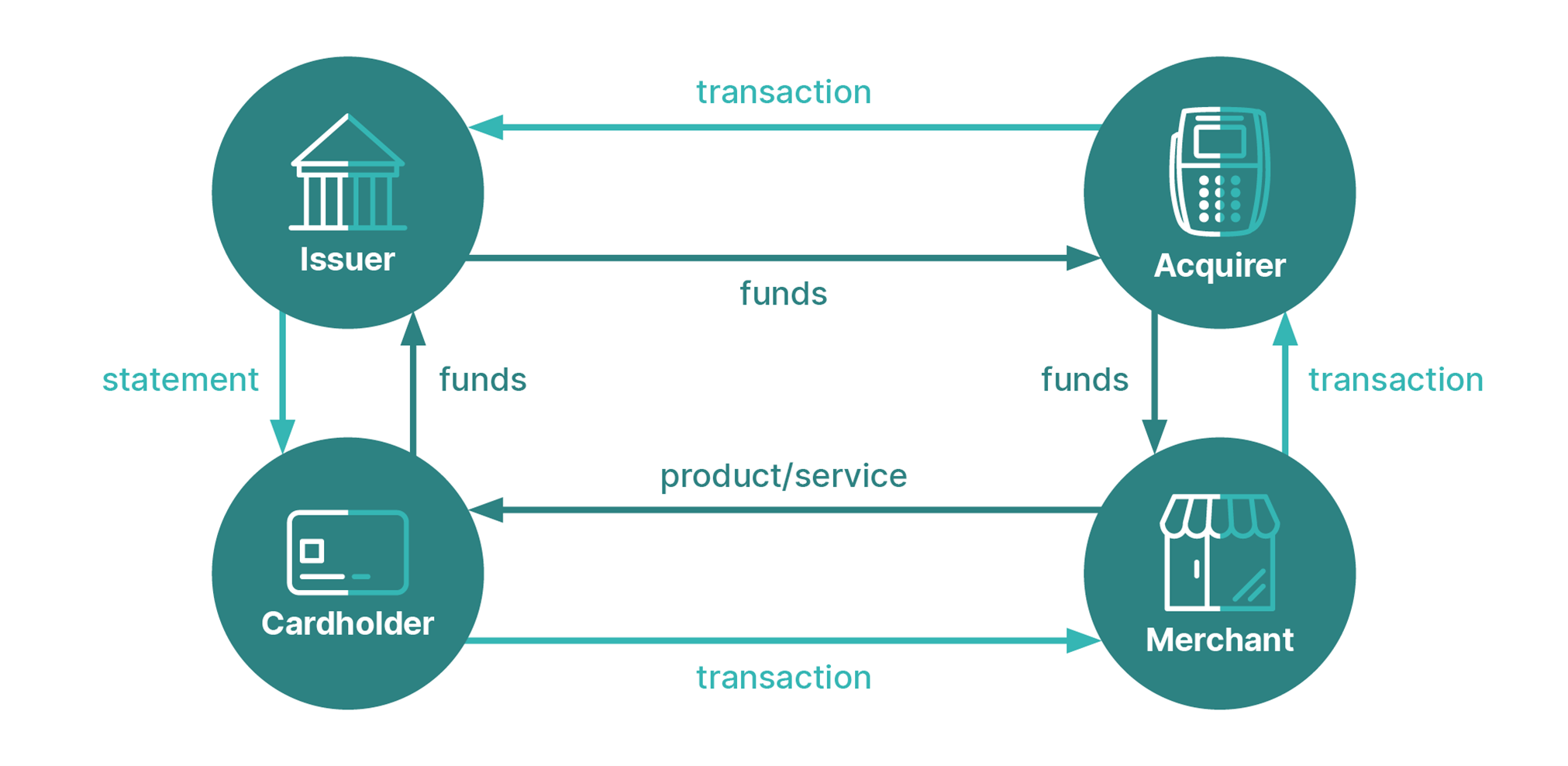

Here´s what the payment process looks like:

- Your customer wants to buy your product either on a physical payment terminal or online

- The client taps their card on the terminal/enters their card details on the payment page

- The information on the card is transmitted through a payment gateway to an acquirer

- The acquirer will then pass on the information to the scheme (VISA/Mastercard)

- The scheme contacts the issuing bank (the customer’s bank) and verifies if there are enough funds available on your customer´s account to complete the purchase

- The issuing bank then sends back a message “approved”/”declined”, using the same exact path

- The acquirer has the ultimate responsibility to capture and move the funds from your customer’s bank to your bank account within a negotiated timeframe

Now, as this process is a bit clearer for some and probably more confusing for others let´s see how you, as a merchant, can benefit from knowing all this? How can you choose a reliable payment partner? Here are the promised tips:

- Look for organisations that can cover most of this payment value chain. If the physical card reader, the online payment page, the processing, the acquiring, and the omnichannel solution are provided by the same company, then this is your best bet. All steps work well together, because they are managed by the same “brain”. Having to deal with five different payment players could much more time-consuming and less efficient for you. With one single provider your total cost of ownership would be lower, compared to having multiple ones.

- When you need specific currencies, payment methods or languages, make sure all of these are supported by the terminal you have chosen, the gateway provider and the acquirer. If even one of these three payment steps does not support your desired configuration, then you are out of luck, because it will not work.

- Verify if the payout from the acquirer to your bank account is settled every day. You need the resources to run your business not in a month or a week, but right now.

- Opt for a payment partner that can offer you both online and in-store payment services. This will guarantee one single reporting where you can clearly see the behaviour of your clients. It will allow you to easily identify and reward the most loyal ones.

- Choose the “path of least resistance” – one contract, one integration, one reporting, one point of contact for all of Europe – this will save you time and money.

Here are some answers to common questions about transaction processing:

Q: Do I need to open a new bank account if I change the company that processes my payments?

A: No, the acquirer will make sure the funds arrive at your company´s bank account

Q: My payments have been processed by XYZ from the very beginning, but my business is growing fast and I have a better deal on the table from another payment company. What would be the cost of change?

A: Close to zero, if no hardware is involved, the change of acquirer/processer can be done from one day to the next enabling you with faster and cheaper options.

Q: How is the price of the transaction determined?

A: The price per transaction has 3 parts: the issuing bank fee (determined by the bank) + the scheme fee (determined by the card scheme) + the acquiring fee (determined by the payment provider). In many cases, especially in online payment, gateway fees are added to the mix. All these fees vary depending on the country, the card type and the industry you are in. When negotiating the whole price, focus on the acquiring fee.

This information should equip any merchant with enough knowledge and ideas on how to get themselves a fair deal with a payment partner. If you have additional questions, please do not hesitate to contact Worldline and discuss this with us. We are here to make your life and experience with payments easier.

Get in touch with our experts: Digital payments for a trusted world (worldline.com)

Velizar Velkov

-

-

Transform your Card Payments platform with Worldline software | Brochure

Learn more -

How Kamera Express reinvents itself and grows internationally

-

Is the payments digital divide increasing?

-

-

Worldline, Antenor and Selfly Store team up to bring advanced, innovative grab-and-go machines with seamless contactless payments

Learn more -

Can you imagine a world without cash?