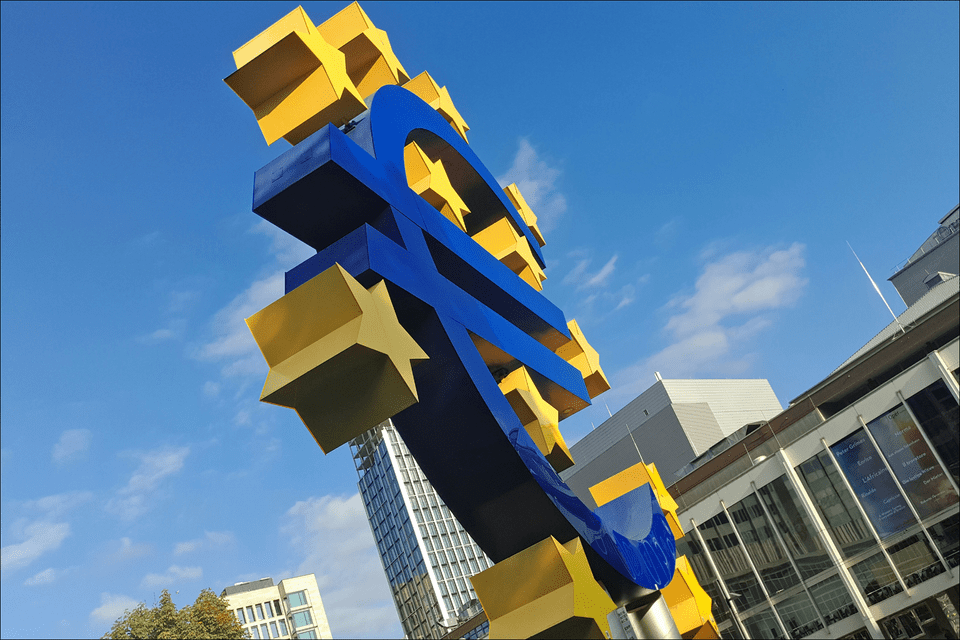

What’s the outlook for CBDCs in Europe?

31 / 05 / 2023

We explore the current landscape and future prospects of Central Bank Digital Currencies (CBDCs) in Europe, the collaborative efforts led by the European Central Bank in the development of the Digital Euro and the potential benefits of CBDCs, such as financial inclusivity and stability. We also discuss the important role that banks and financial institutions can play in supporting CBDC implementation and providing value-added services to customers, leveraging trust and credibility in the digital currency ecosystem.

Rapidly evolving technology has given rise to the development and use of digital payment methods and currencies as the payments landscape shifts towards creating a frictionless experience for customers and businesses.

Some digital currencies, such as cryptocurrencies, have already entrenched themselves in the awareness of the public and global payment infrastructure. By contrast, the yet-to-be-fully realised concept of CBDCs (Central Bank Digital Currencies) is entering the discussion of future payments increasingly positively.

Worldline recently announced its participation in offline digital euro front-end prototype testing, part of the European Central Banks (ECB) investigation phase into the digital euro project. This resulted in the successful delivery of a front-end prototype, significantly contributing to the development of the digital euro, a European-wide venture into the realm of CBDCs.

CBDCs in context

CBDCs are a digital currency for which the holder has a direct claim on a Central Bank, just like physical cash. CBDCs are stablecoins with a value pegged to the currency issued by the central bank.

Many different forms of CBDC are currently in development globally. Beyond regions where established regulation provides a framework for development and implementation, a lack of interoperability and cohesion sometimes leads to highly localised and non-collaborative CBDC projects. Within Europe, however, collaborative efforts are leading to swifter development, with entities such as the European Central Bank leading the investigation and development of the Digital Euro.

Challenges and opportunities

The opportunities presented by CBDCs, such as enhanced financial inclusivity, stability and the ability to coexist with other forms of digital and physical currency are driving development globally. But, challenges do remain. Chief among these is the uncertain public acceptance of CBDCs in many countries where physical cash remains highly relevant or digital infrastructure is still being developed.

The current currency landscape has shifted dramatically in recent years, with cryptocurrencies and other forms of payment representing a power shift away from state and bank monopolies. There is greater competition and a significant need for regulation and legal clarification. This is the space that CBDCs have the potential to fill.

The outlook for CBDCs appears positive within Europe, with the stage being set. With state-regulated and backed currencies such as the digital euro, reliable, trusted and stable access to currencies and banking can be extended to all with access to basic digital technologies.

A strong future in Europe

Within Europe, some barriers against adoption and development that CBDCs face, including elements of trust and security, convenience, usability, inclusivity and interoperability, are being broken down much more swiftly. There is widespread research and several ongoing pilots throughout member states.

Potential benefits of CBDCs, such as improved financial inclusivity, optimisation of payments, lowered reliance on cash and enhanced stability are seen as common goals across Europe, lending to the collaborative efforts and approach needed to produce regional successes capable of use on a global scale.

While the general outlook is positive, implementing CBDCs in Europe remains complex. It necessitates careful consideration of various factors, including technological infrastructure, legal frameworks, security, privacy, and uncertain public acceptance. Therefore, further extensive planning, testing and pilot phases will be needed to test the waters fully.

An unclear role for banks

Banks and other third-party financial institutions may be key to the implementation and sustained success of CBDCs in Europe and beyond. While Central Banks including the ECB, act as custodians for CBDCs such as the Digital Euro, banks can create enticing added services and solutions around CBDCs and digital currencies for the customers. With the rise of digitalised services, trust and validation have become crucial. In this regard, banks can add credibility to the CBDC ecosystem, and support merchants and customers in adoption through more attractive and interoperable services. While banks are certainly not in the driving seat for CBDCs, and their position in the chain remains uncertain, opportunities may still arise. By instilling trust, credibility and creating a better end-user experience, banks may yet leverage a position for themselves regarding CBDCs, and still use the power of digitalisation to their advantage.

Learn more about the Central Bank Digital Currency (CBDC) and the future of money.

Paul Jennekens

Related articles

-

-

-

Consumer Finance: The Transformative Impact of Open Banking & Open Finance

Learn more -

Elevating Service Efficiency: Boscolo Hôtels & SPAS Group's transformation with Worldline’s Integrated Payment Systems.

-

How can we make payments greener?

-

-

Worldline enables GarantiBBVA International N.V. to comply with EU Instant Payments Regulation with cloud-based solution

Learn more -

Learn how NFC payments empower your business