Insights from the first Verification of Payee Scheme Rulebook

12 / 03 / 2024

The Verification of Payee (VoP) is a crucial part of the new Instant Payment Regulation (IPR). This part of the mandatory regulation is mainly designed to fight against the new fraud patterns that take advantage of the immediate and irrevocable execution of instant SEPA credit transfers. The VoP service enables the payer to check both the payment account number (IBAN) and the name of the Payment Counterparty before executing instant and non-instant credit transfers.

In addition to fraud prevention, the VoP is also intended to improve user satisfaction and trust in SEPA account-to-account payments by providing immediate feedback about the correctness of the payment data entered.

To assist the payment service providers (PSPs) in fulfilling their obligations under the Instant Payments Regulation, the European Payment Council (EPC) has published the VoP Scheme Rulebook. This scheme defines rules and standards for verifying the IBAN of the beneficiaries. It enables the necessary interoperability and provides guidance on the scheme rules and the obligations of the participants. The EPC has also published recommendations for the name matching process.

Here are the main topics from the proposed rulebook:

1) Workflow and actors in the Scheme:

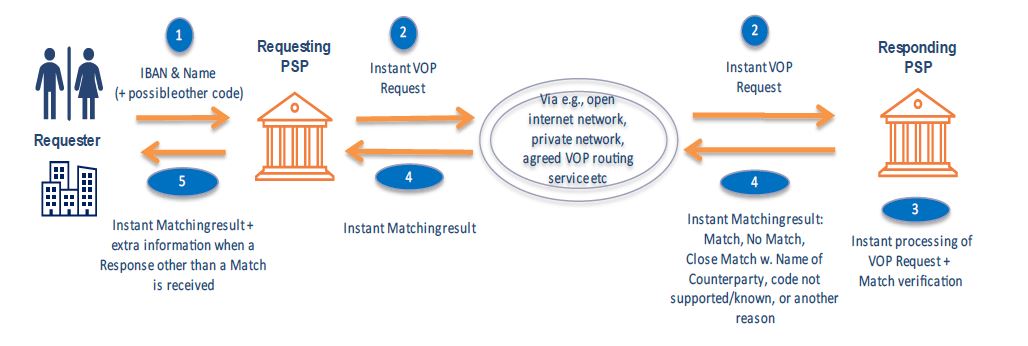

The VoP Scheme defines the following workflow involving these actors:

- Requester (payer)

- Requesting PSP

- Responding PSP

- Payment Counterparty (payee)

Source: actors of the scheme in the EPC VoP Rulebook.

Aditionally the scheme introduces two new roles:

Routing and Verification Mechanisms (RVMs) support the Requesting PSPs with complex routing task and Responding PSPs with the name matching task.

Directory Service Providers who store and maintain all required operational data about participants to enable the necessary interoperability.

2) VoP Process and Dataset

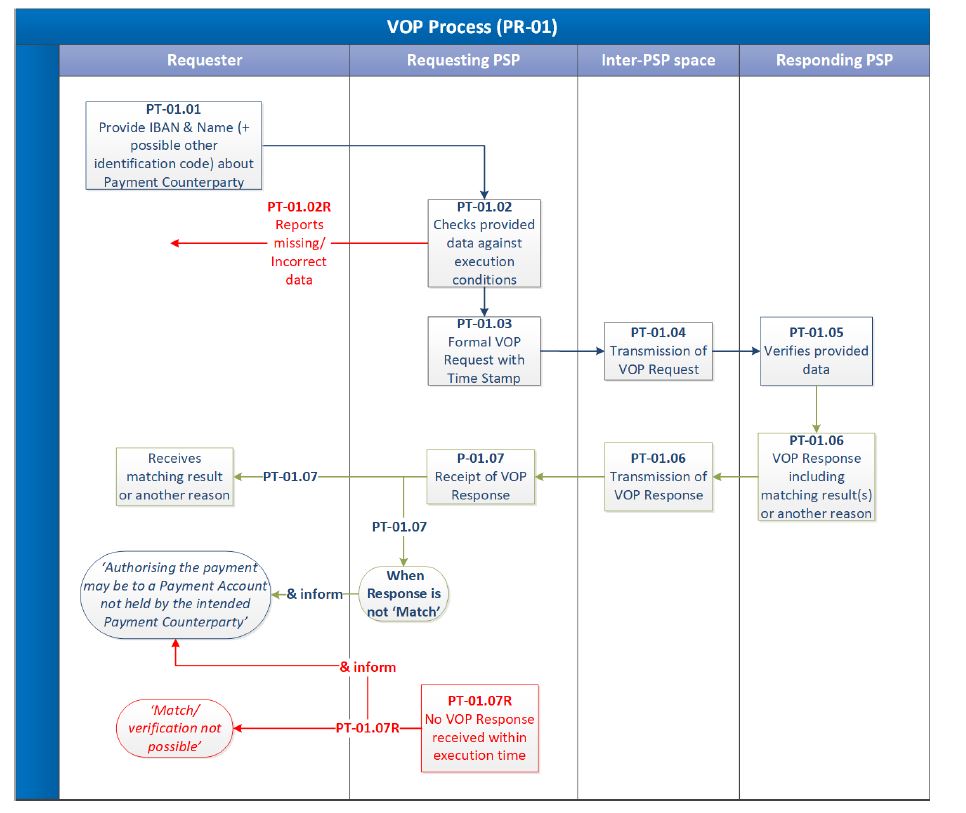

The rulebook describes the processes of the Verification of Payee in detail, and defines the processes where the PSP can use the services of an RVM (Routing and Verification Mechanisms). It is important to note that when an RVM is used the responsibilities and liabilities defined by the Scheme remain with the PSP.

Source: VoP process in the EPC VoP Rulebook.

Aside from describing the different process steps, the rulebook also defines the business requirements of the datasets, including the attributes and rules they contain.

3) Counterparty Name Matching results

The rulebook provides detailed descriptions of the three possible VoP response types (results of the matching): Match, No-Match and Close-Match - for account holder names and identification codes. Additionally, it defines the matching result scenarios in cases where a request contains both the name and the identification code of a counterparty.

In addition to the rulebook, the EPC has also published a first draft of some recommendations for the matching process. As well as describing some concrete scenarios for Close-Match and the combination of IBAN with Identification Code (an alternative identification code to account holder name), it also contains concrete proposals for the necessary account holder data cleanup for the Responding PSPs. This set of recommendations should be viewed as a first set of requirements and will be completed with an appropriate governance process managed by the EPC.

4) Maximum execution time

To ensure a timely and accurate processing of VOP Requests and Responses, the scheme defines a maximum VoP execution time for receiving a VOP Response from the Responding PSP of 3 seconds, but preferably 1 second or less.

For enabling the tracking of this requirement, the Requesting PSP must include a Time Stamp in the VOP Request message to mark the start of the Execution Time Cycle. Upon receiving the VOP Response, the Requesting PSP must promptly inform the Requester about the matching result or failure reasons. If no response is received within the maximum execution time, the Requesting PSP must provide an explanation to the Requester.

Participation in the scheme and obligations for the participants

Only licensed PSPs can become a member of the VoP scheme. The VoP Scheme is optional, so a PSP must apply with the EPC to become a member. Additionally, it defines a list of concrete obligations (technical, organizational, security and legal) for both Requesting and Responding PSPs.

With the publication of this first version of VoP Scheme Rulebook, the EPC has officially started its public consultation, which will last until May 19, 2024. Every interested stakeholder can provide their input for the rulebook and recommendations for the matching process under the VoP rulebook, following the described EPC feedback process:

Learn more about Instant Payments and Verification of Payee. Discover all of our solutions for Financial Institutions.

Henrik Hodam

Related articles

-

Transform your Card Payments platform with Worldline software | Brochure

Learn more -

How Kamera Express reinvents itself and grows internationally

-

What should we expect in 2023?

-

-

Worldline, Antenor and Selfly Store team up to bring advanced, innovative grab-and-go machines with seamless contactless payments

Learn more -

Can you imagine a world without cash?