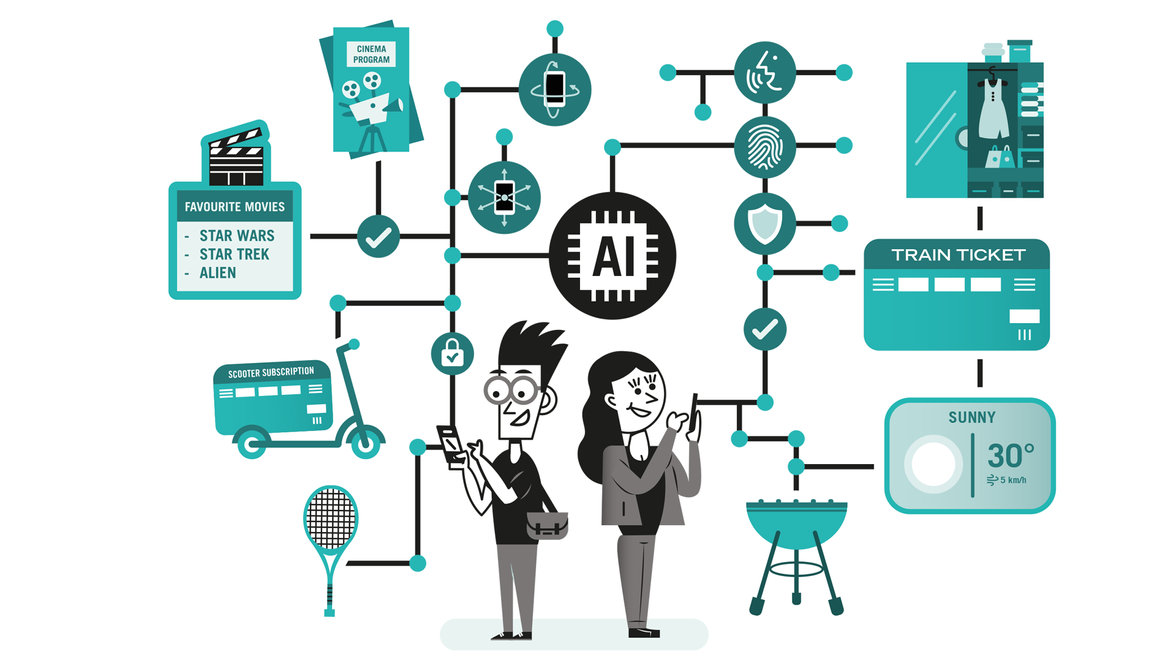

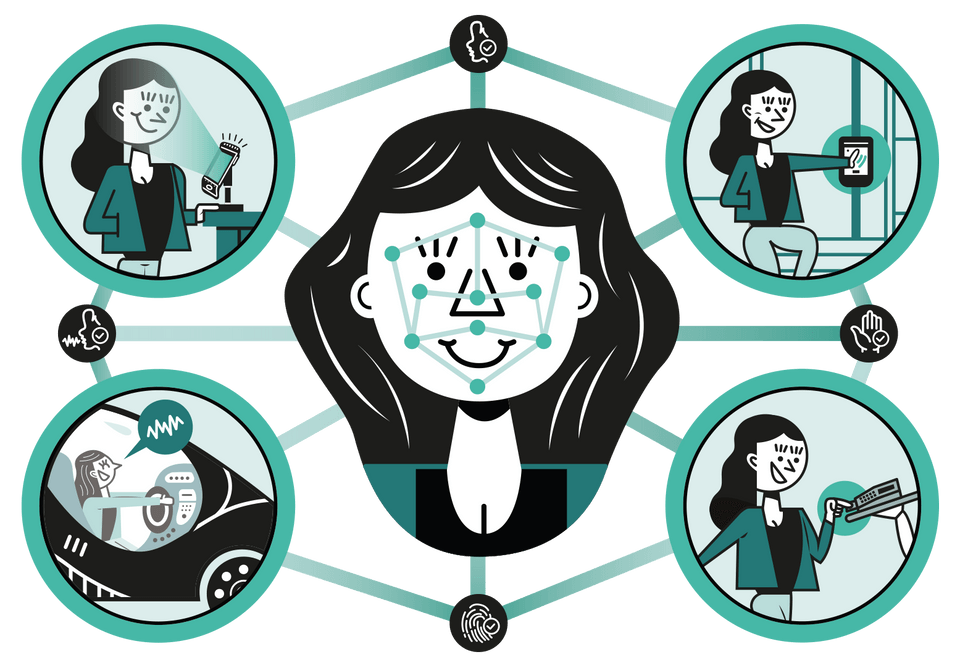

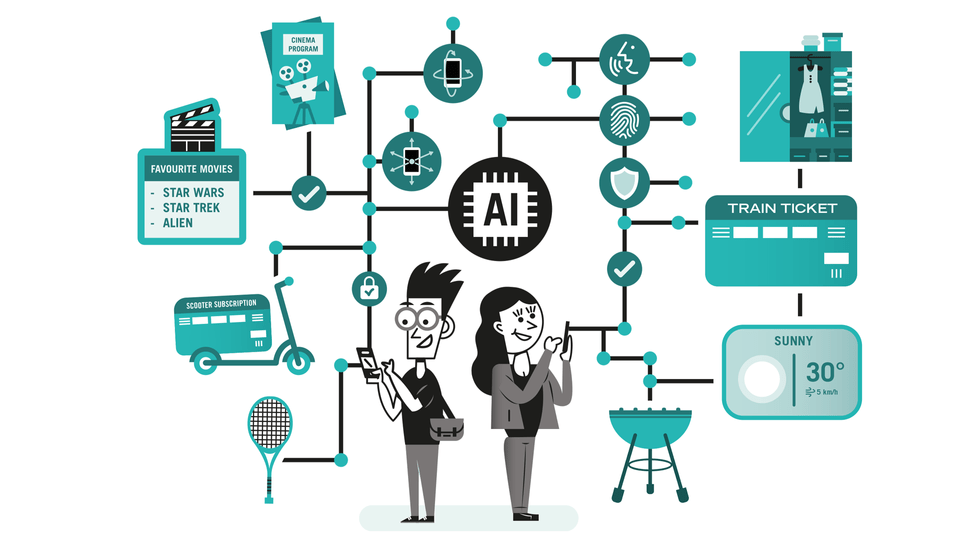

Biometric technology is already commonplace. Every day, millions of people’s identities are checked based on fingerprint and facial recognition so that their payments can be authorised.

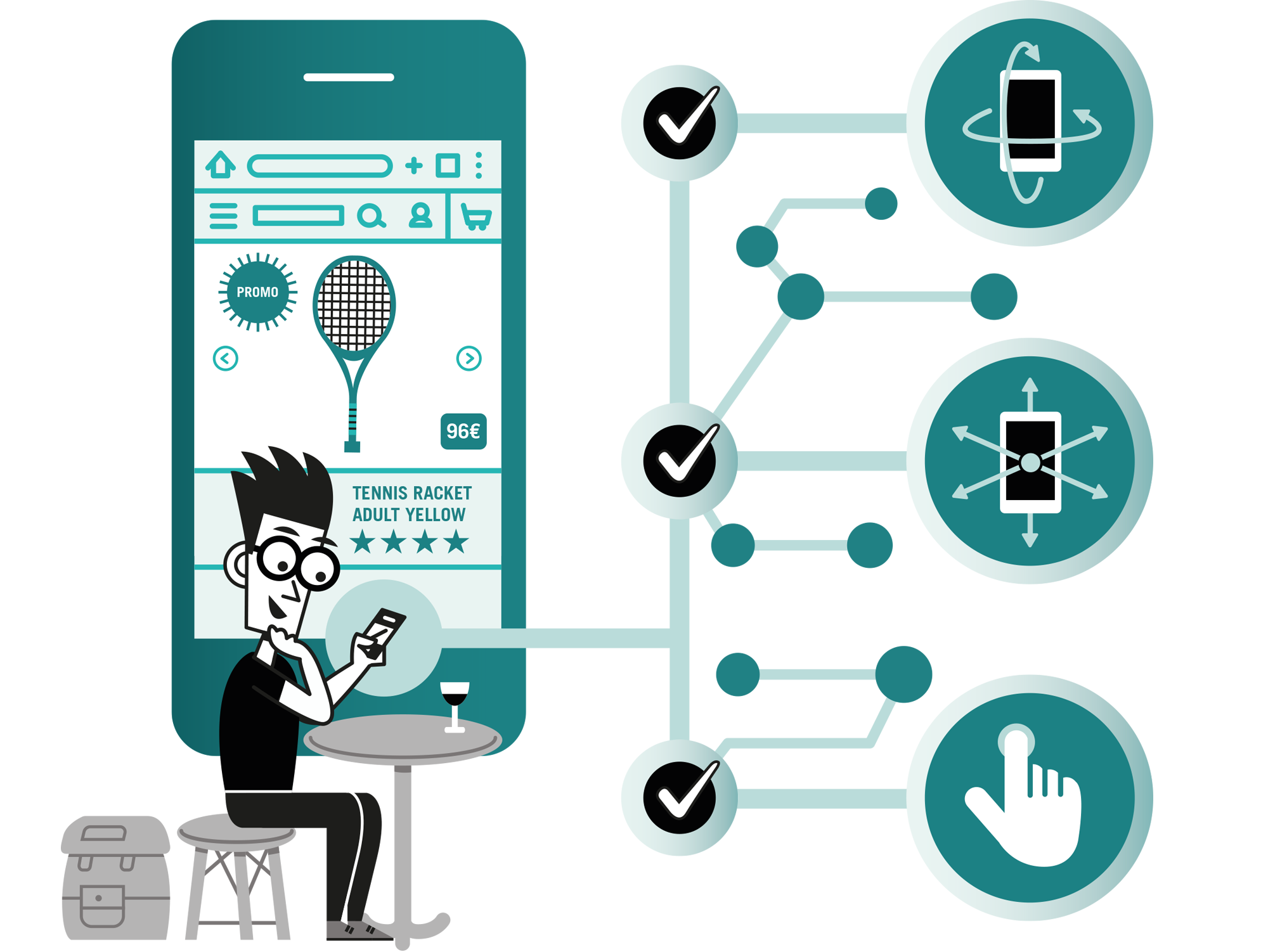

Before long, algorithms will authenticate users based on their unique biometric signatures, such as the way they hold their phone, type on a keypad or use a mouse.

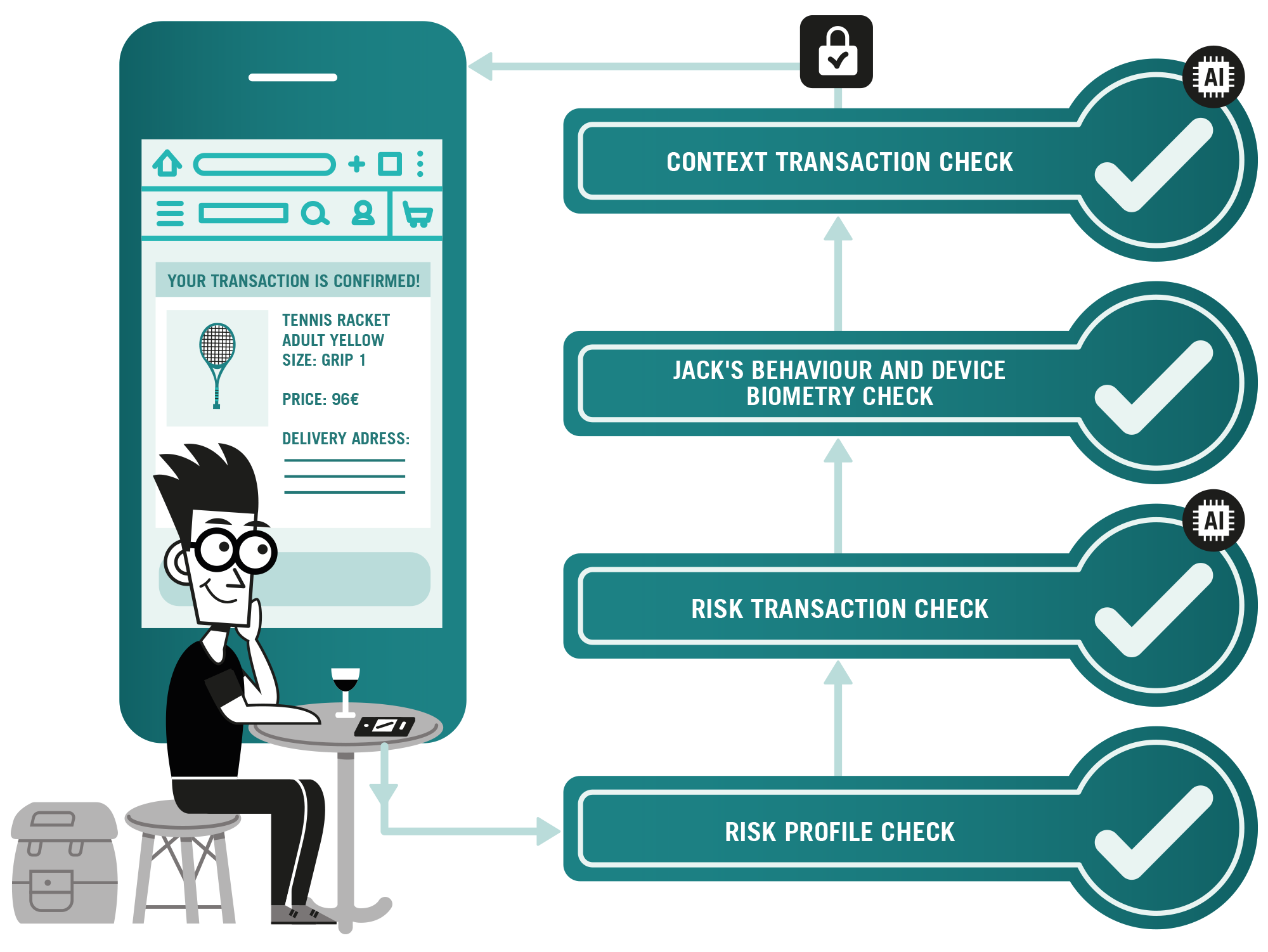

Companies are also using algorithms to analyse large volumes of data and identify higher-risk activities and transactions. Powered by AI, risk scoring and fraud management is becoming more effective.

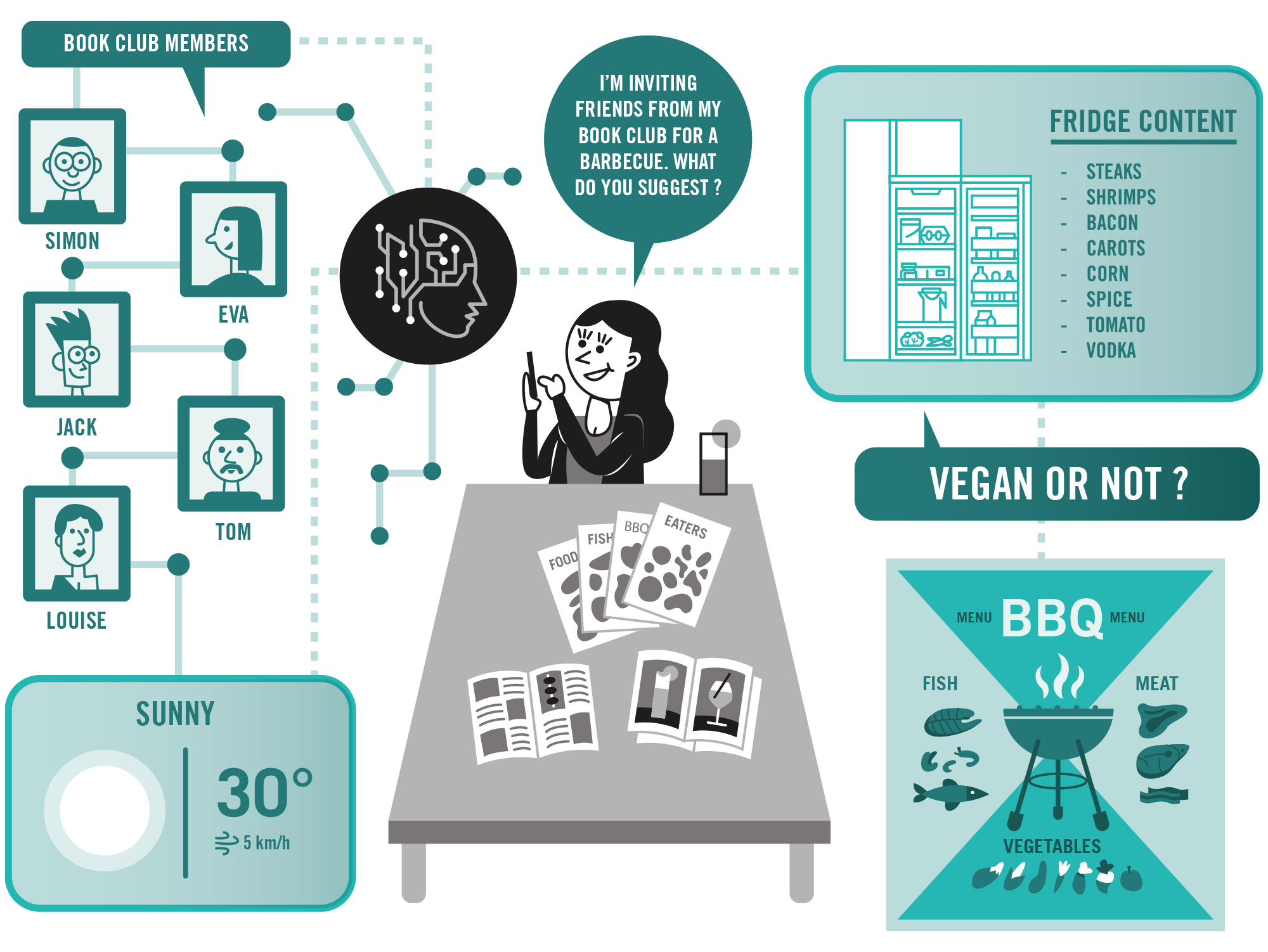

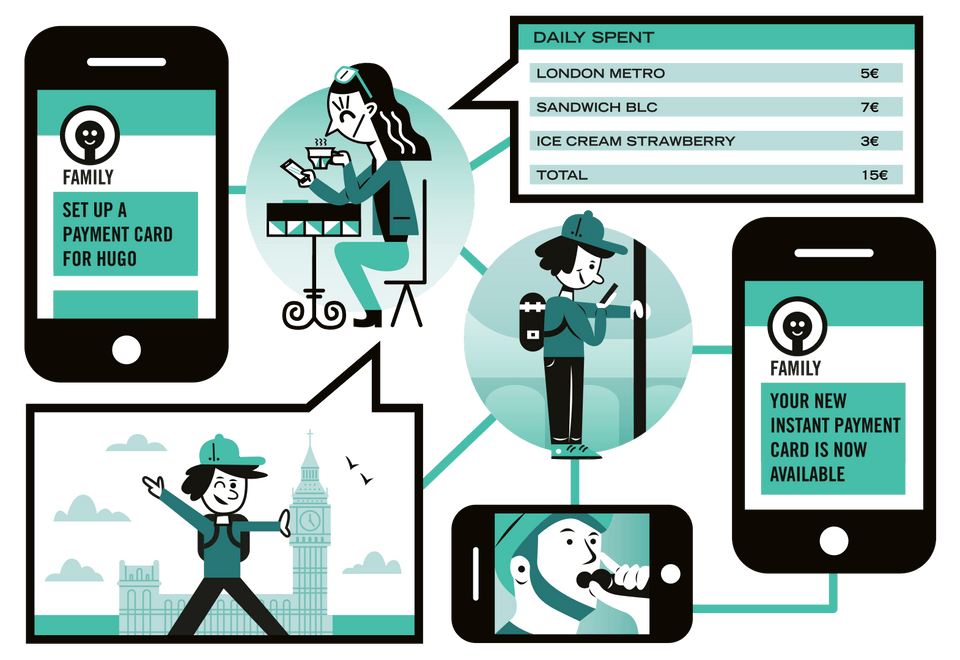

Further into the future, generative AI will transform customer journeys and relationships. Acting as a machine customer, AI will place orders based on information such as the food in a customer’s fridge and their normal meal plan.

These AI assistants will pay for products and services independently. A vehicle’s on-board navigation system will pay for fuel while the driver stays in their car. A fitness tracker on a gym-goer’s wrist will automatically renew their membership. Alongside AI initiated autonomous payment, we will also need to improve transaction risk analysis (based on AI) to avoid accepting fraudulent payments.

Are you ready to offer these conveniences to your customers? Worldline is already actively preparing to accompany you on this journey.