Worldline Payment Orchestration

23 / 03 / 2023

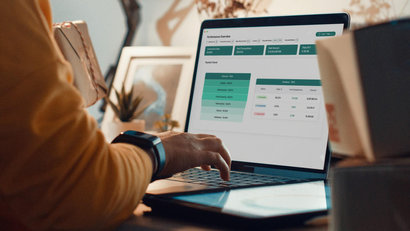

Worldline Payment Orchestration, adding IQ to payments.

In e-commerce, almost no KPI is more significant than the conversion rate, as even a small increase in conversions can significantly improve profits.

However, as a global online merchant, there can be multiple conversion killers: insufficient payment products offered to consumers, payment technology issues, online fraud, card declines, cross-border transition challenges, etc.

Using multiple payment providers can solve many of these problems and deliver compelling commercial benefits. On the other hand, multiple integrations will cause an additional technical burden, and the risk arises that you as a merchant can lose control over your payment strategy.

You might also be interested in

-

-

-

Transform your Card Payments platform with Worldline software | Brochure

Learn more -

How Kamera Express reinvents itself and grows internationally

-

Rethinking in-store payment experiences

-

-

Worldline, Antenor and Selfly Store team up to bring advanced, innovative grab-and-go machines with seamless contactless payments

Learn more -

Can you imagine a world without cash?