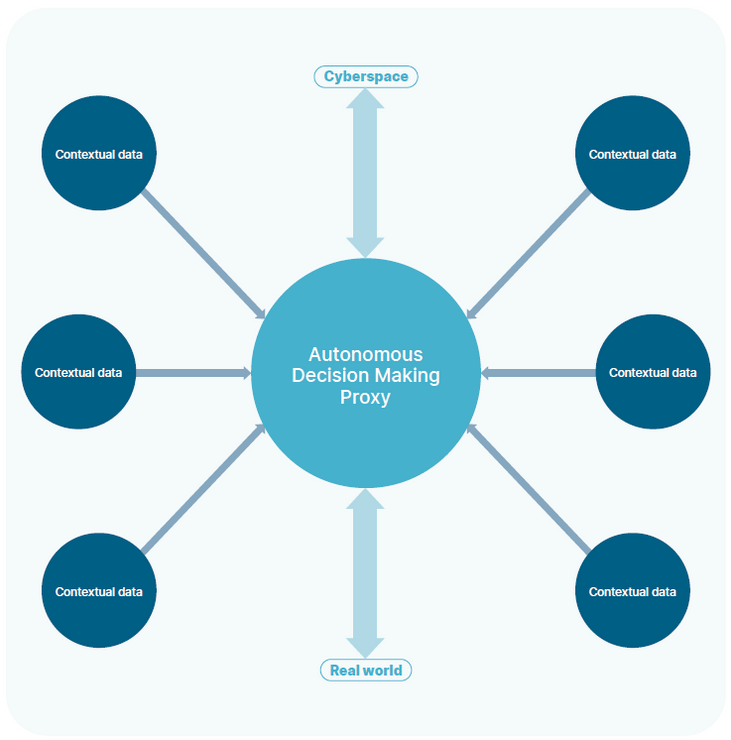

As ever more interactions between consumers and vendors (or just from one human to another) become digital, a wealth of additional data sources becomes available, both from the devices being used and from the myriad of applications accessed via the Internet. These data sources mean that increasingly larger proportions of the data and decision inputs can be inferred via machine learning.

AI can harvest this vast range of contextual data and turn it into recommendations or even use it to make decisions. This is known as hyperautomation.

The payments sector, and more generally the financial services industry, is growing and needs to simultaneously increase convenience, reduce costs and maintain trust, security and agility. This makes financial services an ideal candidate for the autonomous service industry, which aims at improving convenience, seamless customer experiences and efficiency without incurring unmanageable costs. This industry is expected to grow from $345 million in 2019 to $2,992 million in 2024.

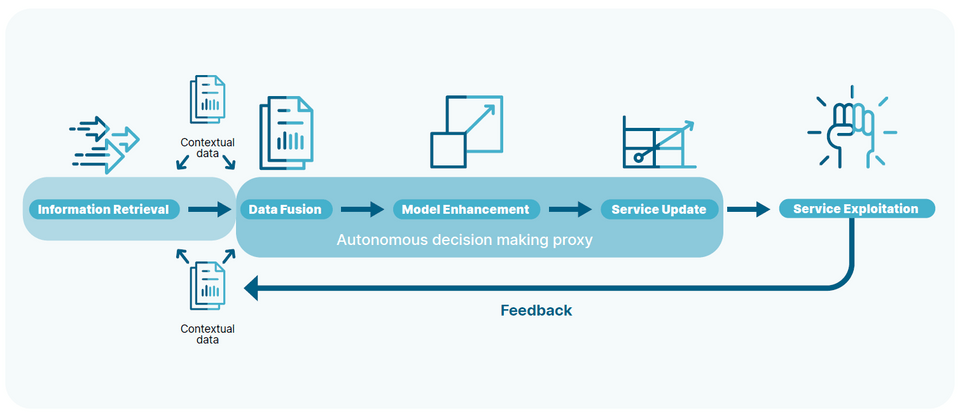

Sequence diagram representing the interactions of information in the operation of the smart proxy

The path towards hyperautomation

Not every business will become more successful by deploying hyperautomation. But sooner or later, those businesses that do manage to make it work for them will use the advantages in efficiency, market responsiveness, security and resilience to their competitive advantage.

To achieve success with hyperautomation, four major topics need to be considered:

Firstly, choose where best to apply hyperautomation. The survival and evolution of a business lies in its ability to renew itself by using, amongst other things, new technologies to gain a competitive advantage.

The key question is where and how to go towards hyperautomation, whilst containing the risks, attaining the quickest wins and retaining control. Taking rapid baby steps may both reduce the risks and increase the benefits.

Secondly, guaranteeing the privacy of big data. At Worldline, we believe that there is significant value in the ability to offer the processing and maintenance of very personal data, if guarantees can be provided that no one processing it can read it in clear format.

One application of hyperautomation could be to allow the minimum amount of data disclosure required for a given service with the maximum convenience. At the same time, maintaining a large amount of contextual data that might one day be useful.

Thirdly, controlling the delegation of decision making. Hyperautomation is no different from machines and automation in that it’s a long journey that starts with small steps. The ultimate objective is to take advantage of AI and computing power to process amounts of data humans would not be able to manage to identify complex or nascent patterns and enable better decision making.

When possible, some levels of autonomy will be progressively given to the AI algorithms after careful consideration, but human input and feedback will always remain the norm for critical decisions since ownership of the decision implies responsibility.

"We expect that human input and feedback will always remain the norm for critical decisions."

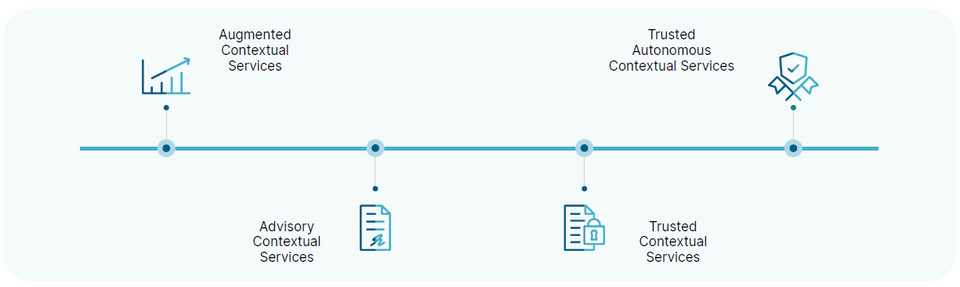

Finally, managing progressive adoption through four milestones.

- Augmented Contextual Services: the service is enhanced and augmented periodically thanks to contextual information.

- Advisory Contextual Services: the service is regularly improved with contextual information and offers advice to optimise results.

- Trusted Contextual Services: the service is regularly enhanced with contextual information, and you can trust parts of its advice based on its proven track record.

- Trusted Autonomous Contextual Services: the service is dynamically improved according to contextual information with a track record giving it the ability to make autonomous decisions within its certified domains.

Timeline for the evolution of contextual services according to the degree of autonomy.

Possible applications of context awareness

The expanding scope of diversity in payment methods, schemes, currencies and compliance regulations makes payments the ideal candidate for hyperautomation to ensure that the cost of payment processing does not rise as this diversity increases.

One application of hyperautomation and context-awareness in payment processing could be to use contextual knowledge to offer a customer the most appropriate payment method, based on their historical preferences and the type of purchase being made.

Another payment related application is for fraud monitoring and risk assessment solutions. Hyperautomation could consider an extensive range of context-related data and decide to reduce the ratio of transactions for which you will require a Strong Customer Authentication. This design could both improve user experience and fraud levels.

Hyperautomation could also be instrumental in the early identification of new fraud patterns, as well as supporting the collection and analysis of data for the dynamic risk scoring of credit-based payments such as instalments or Buy Now Pay Later (BNPL) transactions.

One can also envisage brand new services based on automation. For example, based on an autonomous proxy, a smart financial service would offer an individual the possibility to automatically move funds between their different financial accounts to reduce overdraft fees or optimise returns on their savings.