Credit Insight

Faster, fairer, more accurate credit checking that increases acceptance rates and enhances the customer journey.

Get in touch Explore our APIs Opens in a new tabWhen data works harder, customers get the credit.

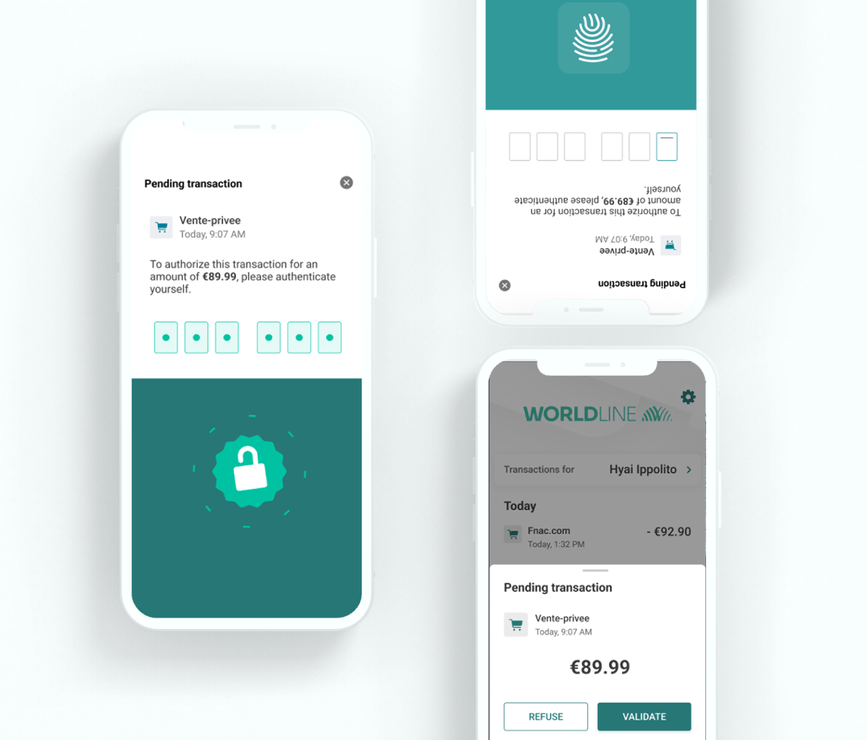

When it comes to open banking credit checks, the choices you make are only as good as your information, which is why Worldline Credit Insight is so important. Backed by an open banking platform, we provide a faster, more accurate way of assessing a customer’s credit worthiness. And that means more efficient, fairer, user-friendly, data driven decisions that can delight customers, increase acceptance and cut defaults.

Credit checking that leaves nothing to chance.

Worldline Credit Insight brings vital improvements to your open banking credit checks, making it next gen in terms of insight and reliability.

Further resources

Start building with Worldline Open Banking APIs.

Ready to create the most delightful and innovative experience for your customers?

Subscribe to the Worldline Financial Services newsletter.

See how Credit Insight can help delight customers and boost business.

Get in touch and we’ll help your open banking credit checks run more smoothly and more effectively.