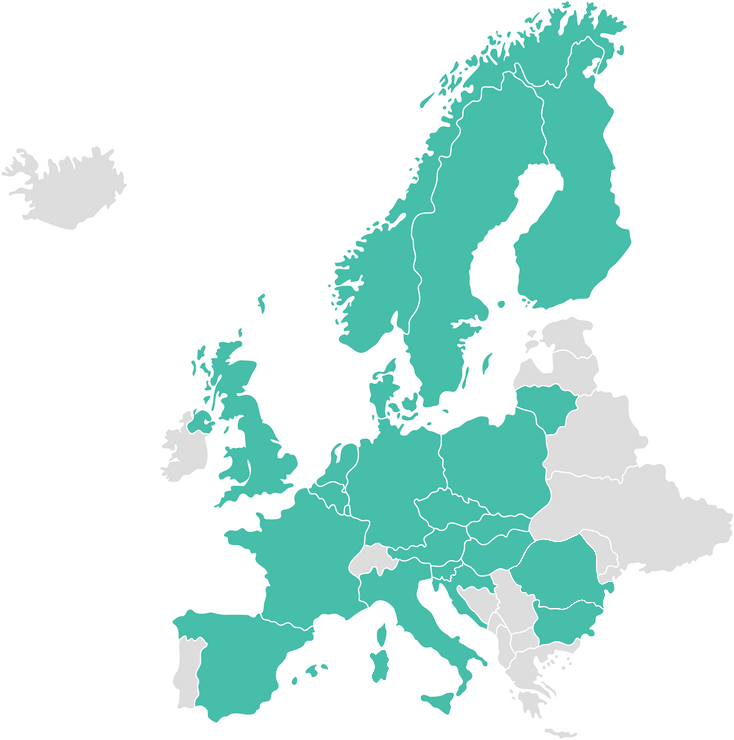

Connection to more than 3.500 European banks in 21 countries

Tap into the potential of open banking with an unmatched combination of reach, scale and value-added services.

Ready to get started? Explore our APIs Opens in a new tabBanks. Fintechs. Insurance companies. Bigtechs. Corporates. Payment service providers. All of these can take advantage of open banking thanks to the opportunities that have arisen from the Payment Service Directive 2 (PSD2). With Worldline Bank Connect, we can connect you to tailored value-added open banking services - through secure access to bank data via one single open banking API to all European banks.

Worldline Bank Connect provides all associated services related to payments and account information. Credit insight. Business Financial Management. Sustainable Banking. Buy Now Pay Later (BNPL). All wrapped up on one central interface supported by user friendly bank selection dialogue.

Connection to more than 3.500 European banks in 21 countries

Ready to create the most delightful and innovative experience for your customers?

Simply fill in a few details and we’ll be in touch to help you unlock the benefits of Worldline Bank Connect.