Worldline announced as “best-in-class” vendor in the debit-issuing market

Paris La Défense — 19 / 10 / 2023

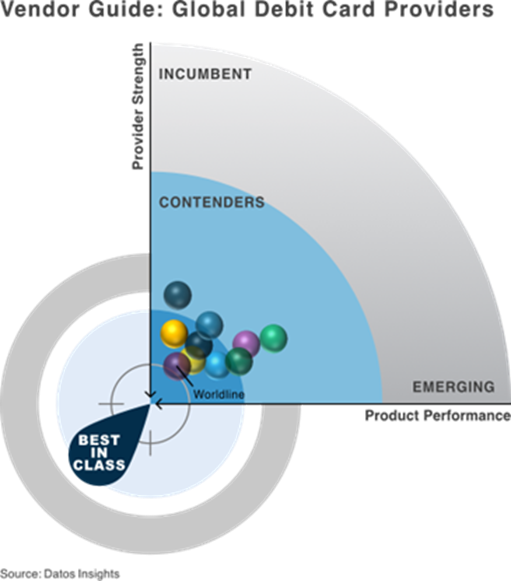

Independent advisory and insights service Datos Insights has shared the findings of an extensive analysis of 14 providers of debit card solutions in the recent report “Datos Insights Vendor Guide: Global Debit Card Providers”. Worldline, a global leader in payment solutions, ranks overall as “best in class,” leading competitors in three out of four analysed criteria: provider stability, client strength, and client service.

As a trusted global partner in the financial landscape and an industry leader in issuing solutions, Worldline values the findings of Datos Insights, whose extensive analysis and reference work reinforces Worldline's position as the leading vendor in the debit card issuing market. "The findings of Datos Insights' report demonstrate Worldline's industry-leading capabilities and the scalable potential of our broad portfolio of products and services," says Alessandro Baroni, Head of Financial Services. "Worldline's position as best in class across key criteria reinforces our commitment to providing our clients and customers the best products, services, and expertise, allowing them to focus on the key potential growth areas of their business."

Datos Insights conducted an extensive global vendor evaluation analysis for debit card solutions. The global debit card market is estimated to reach over 18 billion cards by 2027, highlighting the competitive nature of the market and the need for continual investment. In its report, Datos Insights indicates that, more than ever, digital functionalities are key to positive cardholder experiences. Thus, Worldline’s approach toward personalised, dynamic digital solutions and product portfolios cements its status as industry-leading and client-focused. Additionally, the same report indicates that debit card program owners assess multiple criteria when selecting a provider. As such, gaining a deep understanding of clients’ market needs, choices, and influences can be key to building and developing a broad yet optimised service portfolio.

”The Datos-Insights Vendor Guide is a comprehensive proprietary provider evaluation process designed to provide a holistic analysis of participating providers and identify market leaders in each evaluated provider market. The Datos Insight Matrix provides an actionable guide for market participants seeking viable third-party vendor solutions and services." says David Shipper, Strategic Advisor, Retail Banking and Payments, Datos Insights. "Our goal is to become the leading global provider of insights, data, and advisory services to the financial services, insurance, and retail technology industries.”

Analysis such as that undertaken by Datos Insights is invaluable for pursuing constant innovation and positive investment within the highly competitive and fast-moving payments and financial world. As an independent insights and data service, Worldline values the findings of Datos Insights highly and welcomes the recognition of its robust and adaptable debit card offering.

About Worldline

Worldline [Euronext: WLN] helps businesses of all shapes and sizes to accelerate their growth journey – quickly, simply, and securely. With advanced payments technology, local expertise and solutions customised for hundreds of markets and industries, Worldline powers the growth of over one million businesses around the world. Worldline generated a 4.4 billion euros revenue in 2022. worldline.com

Read our 2022 Integrated Report

Worldline’s corporate purpose (“raison d’être”) is to design and operate leading digital payment and transactional solutions that enable sustainable economic growth and reinforce trust and security in our societies. Worldline makes them environmentally friendly, widely accessible, and supports social transformation.

About Datos Insights

Datos Insights delivers the most comprehensive and industry-specific data and advice to the companies trusted to protect and grow the world’s assets, and to the technology and service providers who support them. Staffed by experienced industry executives, researchers, and consultants, we support the world’s most progressive banks, insurers, investment firms, and technology companies through a mix of insights and advisory subscriptions, data services, custom projects and consulting, conferences, and executive councils.